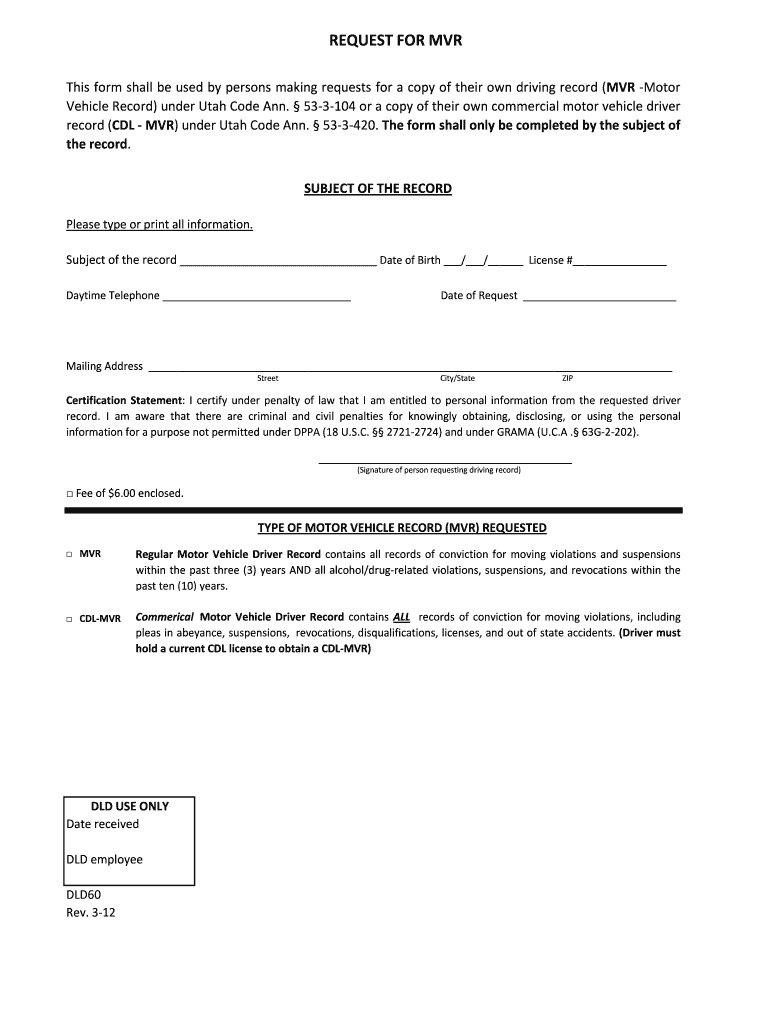

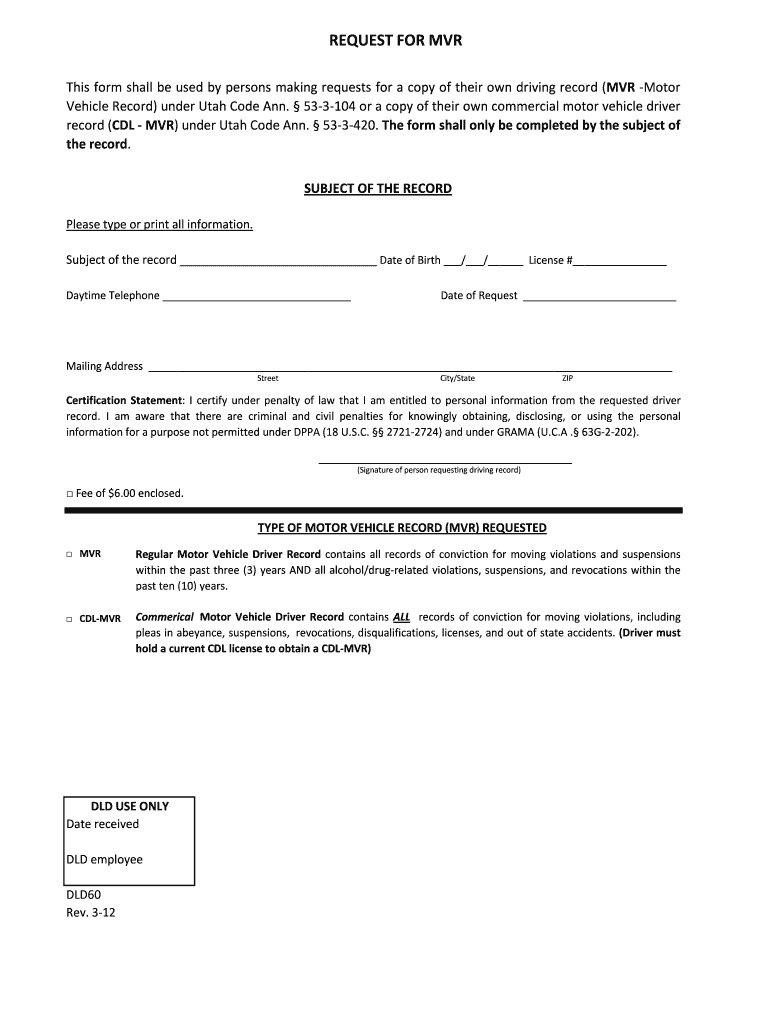

If the request is for an MVR, a driver's license number must be provided — do not use the telephone number.

If the request is for CDL MVR, a driver's license number must be provided, but do not provide a telephone number.

If you have never requested an MVR please do not submit a request.

For safety reasons (for example, a death), it is not recommended submitting a request for a copy of your driving record while driving.

Only one copy of a driver's record is required. If request is for more than one file please include separate copy of the same file. Driver's license number.

Driver's license number (if requesting CDL/MVR),

Date of birth

(if the request is for CDL MVR)

Date of birth

(if the request is for CDL MVR) Telephone phone number

(if not requesting CDL/MVR) If you have an active Utah Driver License, learner permit or restricted license or license plate you may apply for a copy of your driving record and complete this form at the same time. Applicable To.

This form is also accepted at all Department of Job and Family Services offices for obtaining a copy of your driving record.

To obtain a CDL Driver License from Driver License Services:

Complete the form and return it to Driver License Services, 801 SW 1st St, Pleasant Grove, UT 84070

(Address is shown at bottom of form)

To obtain a CDL MVR Driver License from Driver License Services:

Complete the form and return it to Driver License Services, 801 SW 1st St, Pleasant Grove, UT 84070

(Address is shown at bottom of form)

To obtain a CDL from the Department of Motor Vehicles:

Complete the form, the required fee is 18.00, pay to the Division of Driver Services by cashier's check or money order, send the check or money order to: Division of Driver Services

Office of Driver License Services

801 SW 1st Street

PO Pleasant Grove 95523

(Address is on CDL/MVR form)

NOTE: CDL/MVR copies are required for those persons in Utah who hold an active driver's license and hold a CDL or an MVR.

UT DLD60 2012-2024 free printable template

Show details

Driver must hold a current CDL license to obtain a CDL-MVR DLD USE ONLY Date received DLD employee DLD60 Rev. 3-12. REQUEST FOR MVR This form shall be used by persons making requests for a copy of their own driving record MVR -Motor Vehicle Record under Utah Code Ann* 53-3-104 or a copy of their own commercial motor vehicle driver record CDL - MVR under Utah Code Ann* 53-3-420. The form shall only be completed by the subject of the record. SUBJECT OF THE RECORD Please type or print all...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your utah dld60 fill form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your utah dld60 fill form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit utah dld60 fill online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit utah dld60 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Video instructions and help with filling out and completing utah dld60 fill

Instructions and Help about ut dld60 fill form

Fill utah dld60 blank : Try Risk Free

People Also Ask about utah dld60 fill

What region is Utah in?

What percent of Utah is Mormon?

Does UT mean Utah?

Is Utah UH or UT?

What is University of Utah known for?

Which state is ut?

Does UT stand for Utah?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ut utah?

Utah is a state located in the western United States. It is bordered by Idaho and Wyoming to the north, Colorado to the east, Arizona to the south, and Nevada to the west. Utah is known for its diverse geography, including deserts, mountains, and the Great Salt Lake. The state capital and largest city is Salt Lake City. Utah is also famous for its national parks, such as Zion National Park, Bryce Canyon National Park, and Arches National Park.

Who is required to file ut utah?

In Utah, individuals who meet certain criteria are required to file a state tax return. This includes:

1. Residents of Utah: Any individual who is a resident of Utah, regardless of their income level, is required to file a Utah state tax return.

2. Non-residents with Utah-source income: Non-residents who earn income from Utah sources, such as wages, salary, or business income, are generally required to file a Utah state tax return.

3. Part-year residents: Individuals who have lived in Utah for only part of the year and earned income during that period may be required to file a Utah state tax return.

It is important to note that the specific filing requirements can vary depending on factors such as income levels, filing status, and available deductions. Therefore, it is recommended to consult the Utah State Tax Commission or a tax professional to determine your specific filing obligations.

How to fill out ut utah?

It seems that your question is incomplete or unclear. Could you please provide more information or clarify what you mean by "fill out ut utah"?

What is the purpose of ut utah?

The purpose of Utah, the state in the United States, is to serve as a governing entity with the goal of providing a stable and prosperous environment for its residents. Utah's purpose includes maintaining law and order, providing public services such as education and healthcare, promoting economic development, preserving natural resources, and representing its citizens at the state and federal level. Additionally, Utah plays a role in preserving and promoting its unique cultural heritage, particularly regarding its history with the Mormon pioneers and their settlement of the area.

What information must be reported on ut utah?

To provide accurate information about Utah, there are several key areas to cover:

1. Geographical Features:

- Location: Utah is a state located in the western United States.

- Borders: It shares borders with Idaho and Wyoming to the north, Colorado to the east, Arizona to the south, and Nevada to the west.

- Capital: The capital city of Utah is Salt Lake City.

- Topography: Utah features diverse landscapes including deserts, multiple mountain ranges (such as the Uinta Mountains and the Wasatch Range), the Great Salt Lake, and numerous national parks (e.g., Zion, Bryce Canyon, Arches).

2. Demographics:

- Population: As of 2021, Utah has an estimated population of approximately 3.27 million people.

- Ethnicity: The majority of the population in Utah is White, followed by Hispanic/Latino, and other minority groups such as Asian, Black, Native American, and Pacific Islander.

- Religion: Utah is predominantly a religious state with the majority of residents adhering to The Church of Jesus Christ of Latter-day Saints (LDS Church/Mormons). However, there is also religious diversity with other faiths present.

3. Economy:

- Industries: Major industries in Utah include tourism and hospitality, manufacturing, information technology, energy (including fossil fuels and renewable resources), mining, agriculture, finance, and services.

- Employment: Utah has historically had low unemployment rates, with employment opportunities in various sectors.

- Companies: Some notable companies headquartered or with a significant presence in Utah include Qualtrics, Nu Skin Enterprises, Zions Bancorporation, Larry H. Miller Group of Companies, and more.

4. Education:

- Schools and Universities: Utah has a well-developed education system with public schools ranging from elementary to high school. Additionally, the state is home to several renowned universities, including the University of Utah, Brigham Young University, Utah State University, and Southern Utah University.

5. Government and Politics:

- Governance: Utah operates under a republican form of government with three branches: executive (governor), legislative (bicameral), and judicial.

- Political Climate: Utah is often considered a conservative state, with Republicans holding a majority of seats in the Legislature and most top statewide offices. However, there is some political diversity and shifting demographics.

6. Culture and Tourism:

- National Parks: Utah boasts several famous national parks, such as Zion National Park, Bryce Canyon National Park, Arches National Park, Capitol Reef National Park, and Canyonlands National Park.

- Outdoor Activities: Due to its stunning natural landscapes, Utah offers various recreational activities such as hiking, skiing, rock climbing, mountain biking, and river rafting.

- Cultural Heritage: Utah's history is deeply influenced by the Mormon pioneers, whose legacy is seen in the state's architecture, religious practices, and cultural traditions. The state is also home to Native American tribes with rich cultural heritage.

- Salt Lake City: As the state capital and largest city, Salt Lake City offers a blend of urban amenities, cultural attractions (e.g., Utah Symphony, Ballet West), and historical landmarks (e.g., Salt Lake Temple).

These are some essential topics to cover when reporting about Utah, but there may be additional aspects based on the specific context and purpose of the report.

When is the deadline to file ut utah in 2023?

The deadline to file taxes in Utah for the 2023 tax year is April 18, 2024. However, it's always advisable to double-check with the Utah State Tax Commission or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of ut utah?

In Utah, the penalty for late filing of taxes depends on the amount of unpaid tax. If the return is filed after the due date but the tax liability is fully paid, there is generally no penalty imposed. However, if there is a tax liability and the return is filed late, the penalty is calculated as follows:

1. Late Filing Penalty: 2% of the unpaid tax per month or fraction of a month, up to a maximum of 12%.

2. Late Payment Penalty: 1/2 of 1% of the unpaid tax per month or fraction of a month, up to a maximum of 6%.

3. Interest: Interest accrues on the unpaid tax plus penalties, currently at a rate of 4% per year, compounded daily.

It is important to note that these penalties and interest rates are subject to change, so it is advisable to check the Utah State Tax Commission's website or consult a tax professional for the most up-to-date information.

How can I send utah dld60 fill to be eSigned by others?

Once your utah dld60 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit dld60 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your utah dld60 request to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit ut po utah straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing utah dld60 online form right away.

Fill out your utah dld60 fill form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

dld60 is not the form you're looking for?Search for another form here.

Keywords relevant to ut dld60 fillable form

Related to utah dld60 print

If you believe that this page should be taken down, please follow our DMCA take down process

here

.